Crew’s operations are focused primarily in the Montney in Northeast British Columbia (“NEBC”), where we continue to execute on our strategy:

Operations

- Develop our world-class Montney resource, which offers scale and repeatability

- Control costs and generate high capital efficiencies

- Maintain operatorship and high working interest

- Conduct all of our activities responsibly with respect for the environment and the communities in which we operate and reside

Crew’s development capital has primarily been allocated to the continued Montney development of our liquids rich natural gas area at Septimus / West Septimus (“Greater Septimus”), light oil weighted Tower area, and Groundbirch area which offers significant development potential over the long-term. This development focus is designed to provide a platform for long term, profitable corporate growth, and further delineate Crew’s NEBC Montney resource.

The Montney:

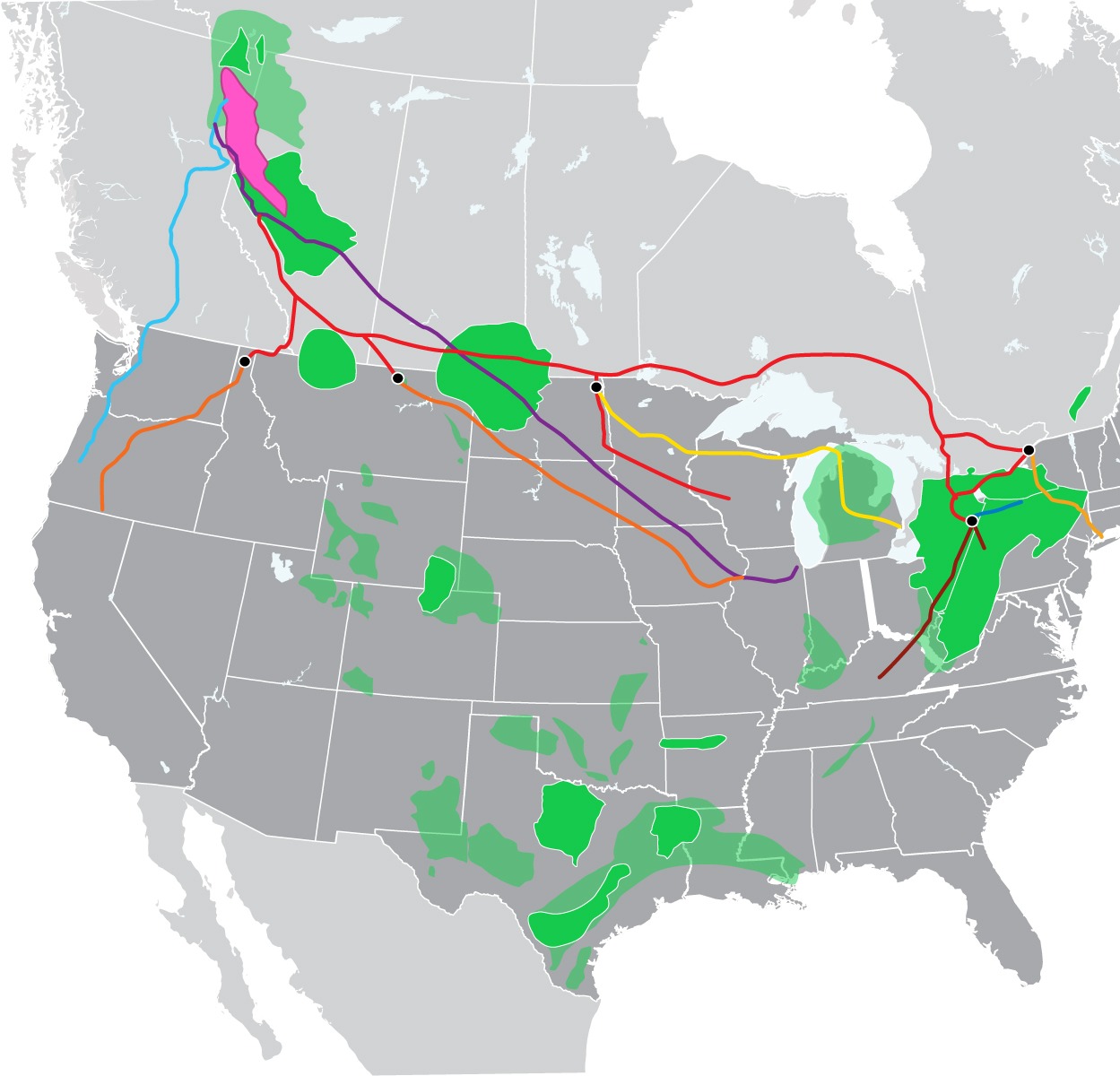

A World-Class Resource Play With Excellent Market Access

The Montney resource play is a very large, siltstone gas reservoir that is situated in the northeast corner of the province of British Columbia in western Canada and ranks among the top natural gas basins in the world.

>1,000 ft thick

Montney formation that is predictable in size and thickness

World-Class Montney Resource Play

Westcoast Energy Pipeline

Alliance Pipeline (to Chicago)

TC Energy Pipeline System

Montney Operations

Our Montney area assets include Septimus / West Septimus, Groundbirch, Monias and Tower, and are situated in northeast British Columbia. Our operations include liquids rich natural gas and light oil production from the siltstone Montney formation. At up to 300 metres thick, the Montney is developed with long-reach horizontal wells, and completed with water-based fracture stimulations.

Crew holds a large, contiguous land base of over 341 net sections in the Montney with condensate, light oil, liquids-rich natural gas & dry gas, with over 2,500 drilling locations identified at the end of 2023.

341

net sections of Montney land held by Crew

>2,500

identified Montney drilling locations

>240

mmcfe per day of infrastructure capacity

Reserves

2023 Reserves Highlights

The following is a summary of the independent reserve evaluation for the year ended December 31, 2023 as prepared by Sproule Associates Ltd (the “Sproule Report”). Please see Crew’s reserves press release issued on February 8, 2024 for further details.

Increases in 1P reserves and 2P reserves

Crew realized a 17% increase in Total Proved (“1P”) reserves and 27% increase in Total Proved Plus Probable (“2P”) reserves over 2022, with 1P reserve additions 129% and 2P reserve additions 600% greater than last year, excluding A&D.

NAV per share represents a significant discount

NAV per share3 totaled $4.33 (PDP), $9.70 (1P) and $18.61 (2P), representing a significant discount to Crew’s current enterprise value.

Meaningful PDP reserve additions

Proved Developed Producing (“PDP”) reserve additions of 7.3 mmboe drove 3-year F&D1,2 and FD&A1,2 costs of $11.23 per boe and $8.61 per boe, respectively, with strong 3-year PDP recycle ratios1,2,4, of 2.0x and 2.6x, respectively.

- “Finding, Development and Acquisitions costs” or “FD&A costs”, “Finding and Development costs” or “F&D costs”, “Reserves Replacement”, “Operating Netback” and “recycle ratio” do not have standardized meanings. See “Capital Program Efficiency” and “Advisories – Information Regarding Disclosure on Oil and Gas Reserves, and Operational Information” within Crew’s February 8, 2024 press release.

- The 2023 change in Future Development Capital (FDC) used in the calculation of Crew’s 1P and 2P F&D and FD&A costs does not include approximately $190 million (undiscounted) in the 1P case and $220 million (undiscounted) in the 2P case of maintenance capital that was reclassified as a capital expense in the December 31, 2021, Sproule Report and maintained the same classification in the December 31, 2023 Sproule Report.

- Calculated based on the Sproule Report before-tax estimated net present value of future net revenue associated with the reserves and discounted at 10% (“NPV10 BT”), debt adjusted per share. See “Advisories – Net Asset Value” contained within Crew’s February 8, 2024 press release for details of the NAV calculations used.

- Estimated operating netback per boe in Q4 2023, used in the above calculations, averaged $22.47 per boe (unaudited). See ‘Advisories – Unaudited Financial Information’ and ‘Advisories – Information Regarding Disclosure on Oil and Gas Reserves and Operational Information’ within Crew’s February 8, 2024 press release.

Crew’s full NI 51-101 Reserves Disclosure for year ended December 31, 2023 will be available within our 2023 Annual Information Form (and also available on SEDAR).